Capital Finance International, winter 2016-2017

Discussions around large current account imbalances among systemically relevant economies as a direct threat to the stability of the global economy vanished in the aftermath of the global financial crisis. As the crisis originated in the U.S. financial system – followed by a second dip in the Eurozone – and global imbalances diminished in following years the issue has faded into the background.

More recently, some signs of a possible resurgence of rising imbalances have returned attention to the issue. We argue here that, while not a threat to global financial stability, the resurgence of these imbalances reveals a sub-par performance of the global economy in terms of foregone product and employment, i.e. a post-crisis global economic recovery below its potential. In addition, we approach how the re-orientation of the U.S. economic policy already announced by president-elect Trump suggests risks of new bouts of tension around global current account imbalances.

Are global imbalances rising again?

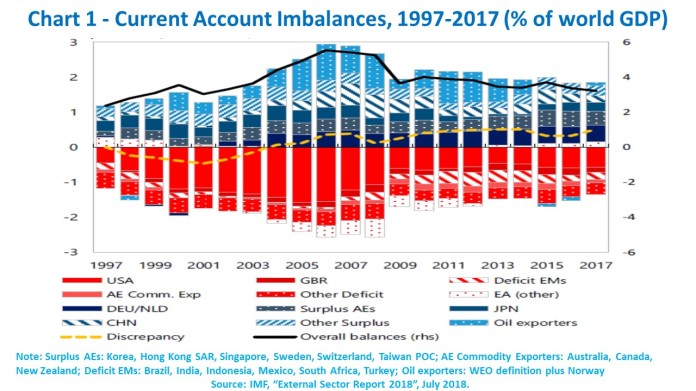

For five years now, the International Monetary Fund (IMF) has produced an annual report on the evolution of global external imbalances – current account surpluses and deficits – and the external positions – stocks of foreign assets minus liabilities – of 29 systemically significant economies. Results for 2015 have pointed out a moderate increase of global imbalances, after they had narrowed in the aftermath of the global financial crisis (GFC) and stabilized later (IMF, 2016a) – see Chart 1.

The evolution of imbalances in 2015 depicted in Chart 1 as explained by the IMF is reflective of three major drivers:

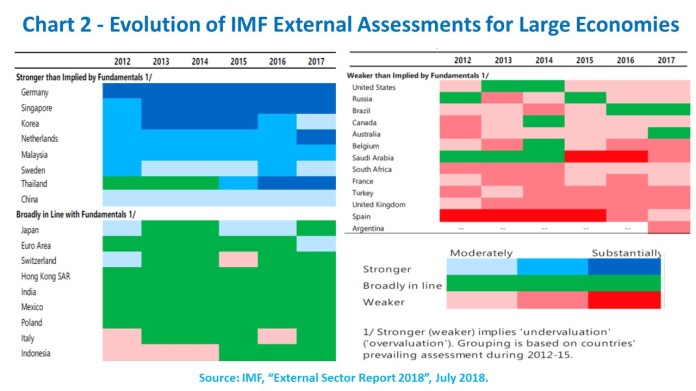

First, the recovery among advanced economies proceeded in an asymmetric fashion. Stronger recoveries in the U.S. and the U.K. relative to the euro area and Japan led to divergence in expected paths for monetary policies and appreciation of the dollar and sterling (pre-Brexit). The deficits of the U.S. and U.K. widened, together with increased surpluses in Japan and both debtor and creditor countries of the euro area (Chart 2).

Second, the fall of commodity prices – especially oil – transferred income from commodity exporters to importers. Overall however, it made only a moderate contribution to the narrowing of imbalances.

Third, prospects of monetary policy normalization in the U.S., as well as bouts of fears about the softness of China’s rebalancing, contributed to a slowdown of capital inflows and depreciation pressures in emerging markets (Canuto, 2016a).

All in all, larger U.S. deficits and augmented surpluses in Japan, the Euro area and China more than compensated for smaller surpluses in oil exporters and smaller deficits in deficit emerging markets and Euro area debtor countries. Hence, global current account imbalances widened last year, even if “moderately”.

However, a picture of higher global imbalances emerges if one focuses on the rising surpluses of two systemically relevant groups of economies. Chart 2 exhibits how in the euro area deficits in debtor countries have shrunk in tandem with the maintenance of surpluses in creditor countries (slightly increasing in the case of Germany). While the net foreign asset position (liabilities) of debtors has not diminished as much, their current account adjustment has added to the soaring surpluses the euro area as a whole runs with the rest of the world. Setser (2016) in turn has called attention to how the six major East Asian surplus economies – China, Japan, South Korea, Taiwan (China), Hong Kong (China), and Singapore – have reverted their post-GFC decline of surpluses and are currently topping even the euro area (Chart 3).

Such double trajectory of rising surpluses gives credence to those who have expressed concerns about a revival of rising current account imbalances as a source of risks to the global economy. While Eichengreen (2014) had declared “the era of global imbalances” to be over, more recently others believe they are “back” and claim that “rising global imbalances should be ringing alarm bells” (HSBC, according to Verma and Kawa (2016). To address this issue, however, it is worth first reviewing how the profile of current imbalances differs from the one prior to the GFC.

Global imbalances have evolved

The “era of global imbalances” up to the GFC (Chart 1) had two distinctive-yet-combined processes at its core:

On the one hand, credit-driven, asset bubble-led growth in the U.S., along with wealth effects, intensified the existing trend of domestic absorption (particularly consumption) growing faster than GDP. This resulted in falling personal saving rates and increasing current account deficits (Chart 4) (Canuto, 2009; 2010).

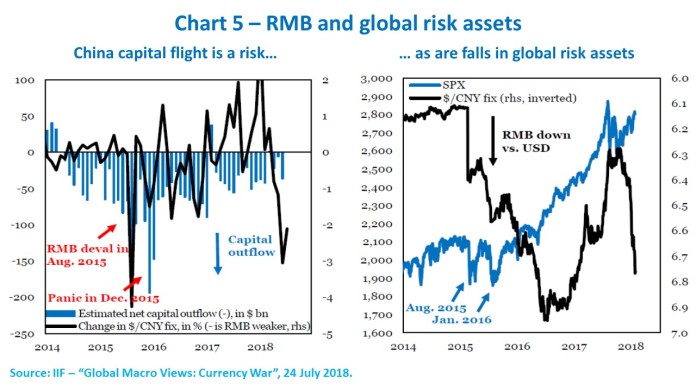

On the other hand, the accelerated structural transformation and rapid growth in China, led to high and rising savings and investments and producing ever larger current account surpluses (Chart 5) (Canuto, 2013a).

Two caveats about these distinctive-yet-combined processes are needed. First, the bilateral U.S. deficit with China in the period decreases by a third when measured in terms of value added, as China became a “hub or a stroke” of value chains with intermediate stages supplied from abroad (Canuto, 2013b). The U.S.-China bilateral imbalance therefore constituted outlets for production beyond China.

Second, while often linked as mirror images of each other – as in the hypothesis of an Asian “savings glut” causing low interest rates and asset price hikes in the U.S. (Bernanke, 2005) – the U.S. asset bubbles were more strongly associated to the “excess elasticity of the international monetary and financial system”, rather than to Asian current account surpluses (Borio and Disyatat,2011) (Borio, James, and Chin, 2014). Global current account imbalances cannot be blamed for the U.S.-originated GFC. As stressed by Eichengreen (2014):

“…the flows that mattered were not the net flows of capital from the rest of the world that financed America’s current-account deficit. Rather, they were the gross flows of finance from the US to Europe that allowed European banks to leverage their balance sheets, and the large, matching flows of money from European banks into toxic US subprime-linked securities.”

Asset bubbles in the U.S. to a large extent were blown by European banks through their balance sheets, by channeling U.S. money market funds into toxic assets. From the U.S.-Europe balance of payments standpoint, short-term outflows from the latter to the former were netted out by simultaneous long-term flows in the opposite direction. Close-to-zero net capital flows hid a lot of financial intermediation and asset-bubble blowing via banks’ balance sheets.

A parallel to that China-U.S. relationship can be traced within the euro area, including its later experience with a second dip of the GFC. The entry of the euro as a common currency was followed by a risk premium convergence toward German levels and to cross-border banking flows at extremely easy conditions. Consequent asset bubbles originated wealth effects and excess domestic absorption – besides inflated financial intermediation – in southern Europe and Ireland, leading to the subsequent debt crisis. The pattern of intra-euro area current account imbalances exhibited in Chart 2 was primarily a consequence of the euphoria taking place under conditions of “excess elasticity” of the euro area’s financial system.

The commodity super-cycle also helped shape global imbalances in this period seen in Chart 1. However, it was to a large extent a consequence of extraordinary global growth prior to the crisis, one in which commodity-intensive emerging market economies maintained growth trends above those of advanced economies (Canuto, 2010).

While such a pattern of global imbalances was unfolding prior to the GFC, much discussion took place about its potential to spark a crisis on its own when faced with a sudden stop. China’s current account surpluses were boosted by depreciated levels of the exchange rate sustained mainly by a piling up of foreign reserves. The same evolution was interpreted by some as an expression of a savings glut unmatched by enough domestic availability of safe-and-liquid assets like U.S. Treasuries.

Regardless of the emphasis of causality one might establish between export-led strategies and saving-glut-cum-safe-asset-scarcity, analysts were split into two camps, as described by Eichengreen (2014). Some analysts feared a possible crisis of confidence in the dollar bringing capital flows to a sudden halt, while others saw imbalances as an exchange of cheap Asian goods for safe and liquid U.S. assets. In the latter case, imbalances might gradually unwind as export-led strategies reached exhaustion and/or the desire for asset accumulation approached satiation.

In any case, the GFC happened before that dispute was settled and global imbalances started to unwind in its aftermath. U.S. personal saving rates began to climb, borrowers reduced leverage, the dollar devalued and the U.S. current account deficit shrank from almost 6% of GDP in 2006 to much lower levels from 2009 onwards. At the same time, as shown in Chart 5, China initiated its rebalancing from an exports and investment-led growth model towards higher domestic consumption and services, including an appreciation of the RMB and lower growth rate targets. This has not meant a straightforward change of trajectory, as caution against a post-GFC hard landing favored continued high investment in domestic housing and infrastructure as a component of the transition (Canuto, 2013a).

As we have already seen, deficits also diminished in the euro area in the aftermath of its debt crisis. The decline in commodity prices also helped global imbalances to shrink.

So, global imbalances did not spark a crisis and have returned in different configuration. Since current account balances are neither expected nor desired to be zero, how to make an assessment of whether the recent “moderate” uptick detected by the IMF might be a bad omen? Do those who have voiced concern over rising surpluses in East Asia and the euro area have a point? To answer these questions, it will be useful to look at the IMF exercise of judgement on whether global imbalances have been “in excess”, i.e. inconsistent with “fundamentals and desirable policies” (IMF, 2016a, Box 1).

How misaligned with fundamentals have current account imbalances been?

National economies are not expected to exhibit zero current-account balances and stocks of net foreign assets. At any period of time, domestic absorption – consumption and investment – can be larger or smaller than the local GDP, triggering inflows or outflows of capital, due to “fundamental” factors:

- Differences in intertemporal preferences and age structures of their populations mean different ratios of domestic consumption to GDP;

- Differences in opportunities for investment also tend to lead to capital flows;

- Differences in institutional development levels, reserve currency statuses and other idiosyncratic features also generate capital flows and imbalances;

- Cyclical factors – including fluctuations in commodity prices – may also cause transitory increases and declines in balances; and

- Countries’ outstanding stocks of net foreign assets also have a counterpart in terms of service payments in their current accounts.

When global imbalances – and corresponding real effective exchange rates (REERs) – reflect such fundamentals, economies are in a better place than they would be in autarky (isolated with zero balances). There are situations, however, in which such imbalances may be gauged as in excess and countries should reduce them – as approached in Blanchard and Milesi-Ferretti (2010; 2011).

There is the straightforward case of imbalances being magnified by domestic distortions, the removal of which would directly benefit the economy. For instance, this is the case when deficits are higher because of lax financial regulation fueling unsustainable credit booms or excessively loose fiscal policies. It is also the case of surpluses that reflect extremely high private savings due to lack of social insurance or investments being curbed because of a lack of efficient financial intermediation. It is worth noticing that, while excessive deficits eventually face a shortage of external finance, surpluses suffer less automatic pressures to dissipate and can therefore persist for longer.

Furthermore, as pointed out by Blanchard and Milesi-Ferretti, there are also situations in which the multilateral interdependence of economies calls for restricting current-account deficits or surpluses. Unsustainable deficits of large, financially integrated economies are such a case, as a crisis associated to them may trigger cross-border effects.

Blanchard and Milesi-Ferretti additionally point out two conceivable situations in which surpluses can be deemed as in excess:

- When current-account surpluses are the result of deliberate strategies of curbing domestic demand and deliberate exchange rate undervaluation, crowding out foreign competitors. On the other hand, given the simultaneous determination of savings and current account balances, it is always hard to disentangle such a strategy from other determinants of the current-account balance.

- When an increase of one economy’s surplus takes place while others face difficulties to absorb it without suffering adverse, durable effects on their demand and output. This is the case when part of the world is caught in a “liquidity trap”, unable to resort to lowering domestic interest rates as an adjustment policy, or face obstacles to use countervailing fiscal policies.

The IMF “External Sector Report” aims to gauge to what extent current account balances and corresponding REERs are out of line with “fundamentals and desirable policies”, as well as whether stocks of net foreign assets are evolving within sustainable boundaries. What did the latest issue show?

Chart 6 displays its assessment of how intensively individual economies have exhibited current accounts – and REERs – that are out of line with their “fundamentals”, i.e. those features that would normally lead them to feature current account imbalances within certain estimated country-specific ranges. Stronger (weaker) corresponds to REER “undervaluation” (“overvaluation”). Stronger (weaker) also means that a current account balance is actually larger (smaller) than that “consistent with fundamentals and desirable policies” (IMF, 2016a, Box 1).

The report notices that the evolution toward less excess imbalances after the GFC has stopped and recent movements have given cause for concern (IMF, 2016a, p. 23):

First, those economies with external positions considered “substantially stronger” (Germany, Korea, Singapore) or “stronger” (Malaysia, Netherlands) have remained as such for the last 4 years. Also noticeable has been the shift toward stronger positions in the cases of Thailand and Japan.

Second, at the bottom of the distribution, while some countries reduced – or suppressed – degrees of “weakness” (Russia, Brazil, Indonesia, South Africa, and France), others remained (Spain, Turkey, United Kingdom) – with the addition of Saudi Arabia to this group after the oil price decline.

Third, on-going trends of current account imbalances are bound to lead to a further widening of some external stock imbalances accumulated since the GFC. While China’s external stock position is expected to stabilize, other large economies are projected to exacerbate their debtor (U.S., UK) and creditor (Japan, Germany, Netherlands) positions. Furthermore, the net foreign asset position of some euro-crisis countries remain highly negative despite years of flow adjustment with high unemployment and low growth.

In our view, although not giving ground to fears of a collapse in major financial flows, global imbalances have not gone away as an issue, as they reveal that the global economic recovery may have been sub-par because of asymmetric excess surpluses in some countries and output below potential in many others. The end of the “era of global imbalances” may have been called too early. Lord Keynes’ argument about the asymmetry of adjustments between deficit and surplus economies remains stronger than ever.

The IMF report has a point in calling for a “recalibration” of macroeconomic policies from demand-diverting to demand-supportive measures. This would be particularly the case for countries – or the Eurozone as a whole – currently able to resort to expansionary fiscal policies that have instead relied mainly on unconventional monetary policy – which has become increasingly ineffective at the margin. On the other hand, one must acknowledge that there are limits to which national fiscal policies can deliver cross-border demand-pull effects. Huge savings flows – like German or U.S. corporate profits – may also not be easy to redeploy.

Hence specific priority should be given to country-specific structural reforms addressing obstacles to growth and rebalancing. Which could be aided by cross-border dislocation of pools of savings currently parked in low-return assets. Paradoxically, global imbalances demand more globalization in a moment when the latter faces hurdles (Canuto, 2016b).

Implications of U.S. future trade and macroeconomic policies for global imbalances

Given the weight of the U.S. economy, global imbalances may undergo new shocks in the coming years as a result of the policy reorientation already announced by president-elect Donald Trump. Although at a preliminary stage, it is possible to devise two possible scenarios, the choice of which will depend on the options assumed by trade policies accompanying the macroeconomic reorientation.

President-elect Trump and his team have announced a macroeconomic platform with a likely strong potential impact: a major fiscal boost via infrastructure spending, corporate tax cuts, and a (financial and environmental) deregulation agenda (Canuto & Cavallari, 2016). Such platform underlies the announced goal of raising the U.S. economic growth to 4% a year, well above the potential 2% estimated by the IMF (IMF, 2016b).

Important details are yet to be filled out. For example, how much of the US$ 1 trillion of infrastructure investment pledged will be borne by the public sector or by public-private partnerships, and therefore how much of it will contribute to public sector deficits and debt. As suggested by different experiences around the world, including the United States, sudden increases in public investment are not easily implemented. The increase in investments in infrastructure will take some time to implement and there will be a lag in their effects, on both the demand and supply side.

Similarly, given that U.S. corporations currently display already high liquidity reserve buffers and low levels of acquisition of new fixed assets, the results of corporate tax reduction on their expenditures will depend significantly on the terms of conditions of local investment that may be attached. Such type of conditionality has already been alluded to in the case of profit repatriation.

There are also doubts as to the extent of the impacts of deregulation. In the case of finance, given the favorable climate in Congress and beyond to reforming the Dodd-Frank regulation, one can expect a relief from the regulatory burden that has been inhibiting bank credit in recent years. Environmental deregulation may also facilitate investment in the energy sector, particularly on shale oil and gas.

Assuming that, in fact, aggregate demand is stimulated, there remain doubts as to the current capacity of the response of domestic supply. After all, low rates of involuntary unemployment and upbeat levels of economic activity at the end of the Obama administration will be part of the latter’s legacy. In the event of binding supply limits, the macroeconomic effect will be largely directed to higher inflation and import growth. The frenetic appreciation of the dollar in the weeks following the initial announcements of Mr. Trump’s program reinforces the possibility of greater demand leaks via foreign purchases of goods and services.

In any case, a drastic change in the current regime of fiscal and monetary policies is likely to occur. The normalization of monetary policy by the Federal Reserve toward higher interest rates and smaller balance sheets tends to accelerate, while fiscal policy will definitely leave the consolidation path forced by Congress to the Obama administration in recent years. In effect, the U.S. is one of those cases in which the IMF – and others (Canuto, 2014) – have long advised a shift from monetary easing to expansionary fiscal policies. The appetite in the markets for Treasury bonds has been far from satiated and larger public deficits would be easily absorbed, for which it would suffice to issue signs of future reforms toward some smoothing of the public debt path.

It is in trade policy and in dealing with current account imbalances that two scenarios emerge: a “soft” scenario is the one in which the Trump government limits its campaign promises to occasional “arm twists” with corporations, like moral suasion and tax concessions in exchange for local investments or import substitution within value chains. The “hard” scenario would be to establish extraordinary tariffs and other restrictions on imports – China and Mexico were frequent targets of such threats during the election campaign.

In the “soft” scenario, there will be a demand stimulus for the rest of the world, albeit at the cost of greater current US imbalances which would not likely face financing difficulties. The “hard” scenario, in turn, contains high risks of substantial price increases in the domestic basket of goods and services, as well as of having a negative impact on the profitability of U.S. corporations. In addition, if followed by “trade wars” with countries directly affected, a “lose-lose” result in the global economy – as in the 1930s – could materialize (Canuto, 2016b). After all, the US economy nowadays has levels of trade and financial integration with the rest of the world sufficient to generate significant feedback loops.

Bottom line

Current account imbalances in the global economy have returned to the spotlight, albeit with a different configuration from the one that marked the trajectory prior to the global financial crisis. Not as a particular threat to global financial stability, but mainly because they reveal asymmetries in adjustment and post-crisis recovery between surplus and deficit economies and, in the coming years, for the risk of sparking waves of trade protectionism.

Otaviano Canuto is an Executive Director at the World Bank (WB). All opinions expressed here are his own and do not represent those of the institution or of those governments he represents at the WB Board.